Homeowners insurance ct helps protect you from damage caused by theft, fire or other disasters. Liability coverage is also provided if you are sued by someone who was injured on your property or in your house. It can also help cover your living expenses if you are displaced due to a loss.

The best homeowners insurance in ct will be affordable and meet your budget. It should offer excellent customer service and a variety of coverage options, as well as have a solid rating for financial strength.

The cost of homeowners insurance will vary depending on many factors. They include your location, the level of protection you choose and your property's risks. A provider will check your score and possibly offer you an insurance plan only after they have checked your credit.

Compare multiple quotes before you make your final decision. MoneyGeek.com allows you enter your zipcode and size of house and it will compare home insurance rates.

The best way to protect your investments is by selecting the best homeowners insurance. Connecticut has many beautiful places to live. However, it also poses some risks. It is also susceptible to hurricanes and floods during the winter.

Home insurance policies should not only protect your home, but also cover your possessions and any structures you own. You can purchase additional coverages for your personal property to help cover jewelry, antiques, coins and other valuable items.

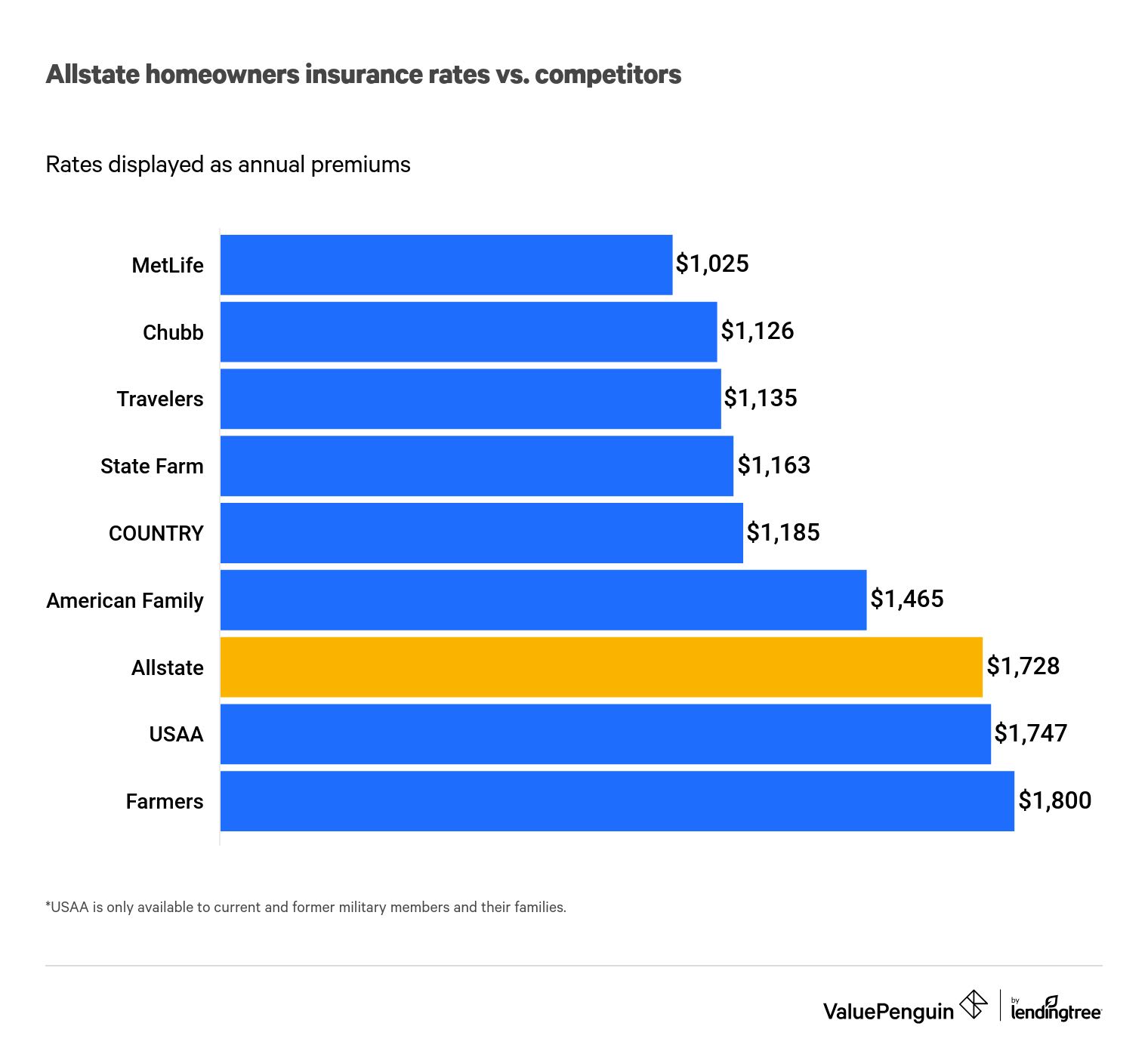

There are many different insurance companies that offer homeowners' insurance in CT. There are many different companies that offer homeowners insurance in CT. Each one has unique strengths and weakness, so you should compare them to find out which is the best fit for your needs.

Allstate provides some of the most affordable homeowners insurance in Connecticut. They offer a wide range of policies to suit your specific needs. This company provides discounts on your premiums.

Amica Mutual offers a variety of home insurance options that can be tailored to your specific needs. The company has a great customer service track record, and also offers a contractor referral programme. Amica agents are able to help you find an experienced contractor for any repairs that your house may need after a covered loss.

USAA offers excellent benefits at affordable rates for military personnel and their families. It offers a comprehensive insurance policy which includes replacement costs for dwellings and contents. It offers a rideshare insurance add-on that helps protect drivers for ridesharing services.

Chubb also offers high-quality home insurance ct. Its policies include a range of coverage benefits, such as extended replacement coverage or identity theft protection.

Every year, you should review your home policy to make sure that it provides the best protection for your property and personal items. Reviewing your policy is important when you change addresses or move to a new house. This will help you understand what kind of coverage you have, and whether you need to make any changes.