It is a great way for your pet to be protected. It can also protect your clinic, which can prove to be very useful in the unfortunate event of a natural disaster. One example is when a vet's clinic is damaged by fire or when an animal clogs a drain. These situations can lead to a high vet bill. A veterinary surgery insurance policy will protect your assets and staff.

American Veterinary Medical Association (AVMA), is one of the most respected organizations for veterinary practitioners. It offers a range of insurance options. They can help to find the right policy that covers your practice and your assets.

You need insurance if you own a small practice of veterinary medicine. This can protect your business against a number of risks, from loss of income to legal action. Not only will it protect your practice, but it can also help you stay focused on your business.

The "keyperson absence" coverage is a standard protection for pet health insurance. This coverage means that your veterinarian will always be available for your pet in case of emergency. However, this is not an always-available option.

Another common pet insurance feature is liability insurance. Liability insurance is designed to protect your business from lawsuits, damage to your property, and the injuries of your employees.

The vet fees coverage is the most crucial feature of any vets insurance policy. You can choose to cover your pet's vet bills or not. Your vet will get a percentage of your total vet bill if you pay your co-pay and deductible.

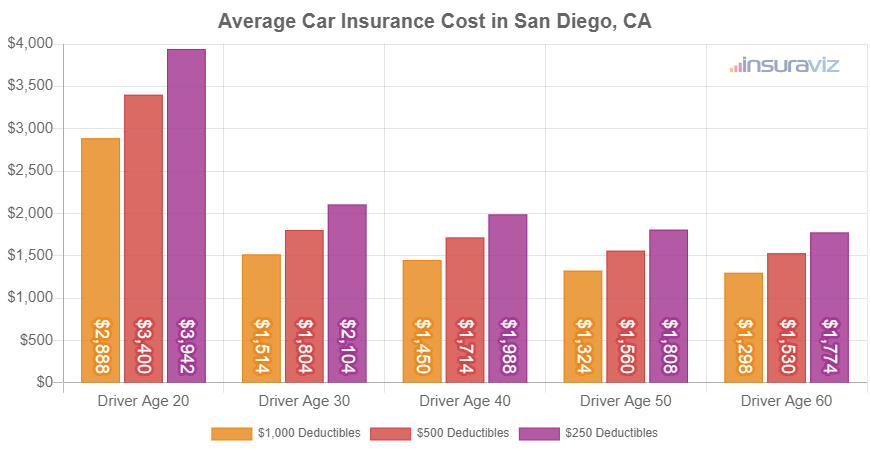

Also, be sure to check the deductible and the cost of a vets' insurance policy. Most policies will deduct a percentage of the total treatment claim. This is usually a small percentage. Some policies don't cover pre-existing health conditions. Before you sign up for a plan, be sure to read the terms.

There are many types of pet insurance. However, they all offer one benefit. This means that they will cover a vet fee for a particular condition. Some insurance providers will only cover the copay while others will deduct the entire amount. Get the best deal by comparing quotes from multiple companies.

Whether you're running a small practice or a large operation, it's a good idea to purchase a veterinary surgery insurance policy. Many policies can be customized to meet your needs.

Even the most comprehensive plans will have limitations. The typical policy covers only the smallest medical claim. You may need to wait several years to be eligible for benefits. Many policies do not cover lab tests, or only cover certain conditions.

It is important to remember that insurance companies won't cover pre-existing conditions. The vet should be informed when you purchase the policy.