Arizona homeowners must have their own insurance. Due to the high hazard risk in the state and the potential for a fire or flooding, homeowners should have insurance. It is best to insure your home with the best insurance company in arizona.

Homeowners Cost Insurance - Arizona

Arizona has an average annual cost of $1602 for homeowners insurance. You can find affordable Arizona homeowners insurance by shopping around.

Installing devices to protect your home can save you money. This will reduce the claims that are made and your premiums. These include deadbolt locks, smoke alarms and burglar alarms.

A separate earthquake policy is essential for those who live in areas that are prone seismic activity. This type covers the cost of repairing or rebuilding your house after an earthquake.

Earthquake coverage is not part of your homeowners insurance, but many insurers provide it separately. If you choose to purchase it, the deductible is between 10% and a quarter of the policy limit for your home.

Arizona Homeowners Insurance Policy exclusions

You may be surprised at the number of problems that could affect your house and its contents. Home insurance policies cover many normal events like fires and sinkholes. They also cover earthquakes, power failures, flooding, insect infestations, nuclear hazards, and other natural disasters.

Floods, sinkholes and earthquakes are usually excluded from a home policy in AZ. Also, vermin and insect infestations, nuclear hazards, war, and normal wear and tear. Read your policy thoroughly to ensure you understand what is covered.

Best Home Insurance Companies for Arizona Homes of Different Types

Country Financial provides a good customer service and a reasonable rate for Arizona homeowners. The company offers a variety of discounts and coverages to meet your needs.

Arizona homeowners insurance: How to Choose the Right Provider

The average Arizona home is worth over $200,000. It is possible that you could have damage to your home from a number of sources. A homeowners insurance policy will protect you and your home from everything, including vandalism, theft and fire.

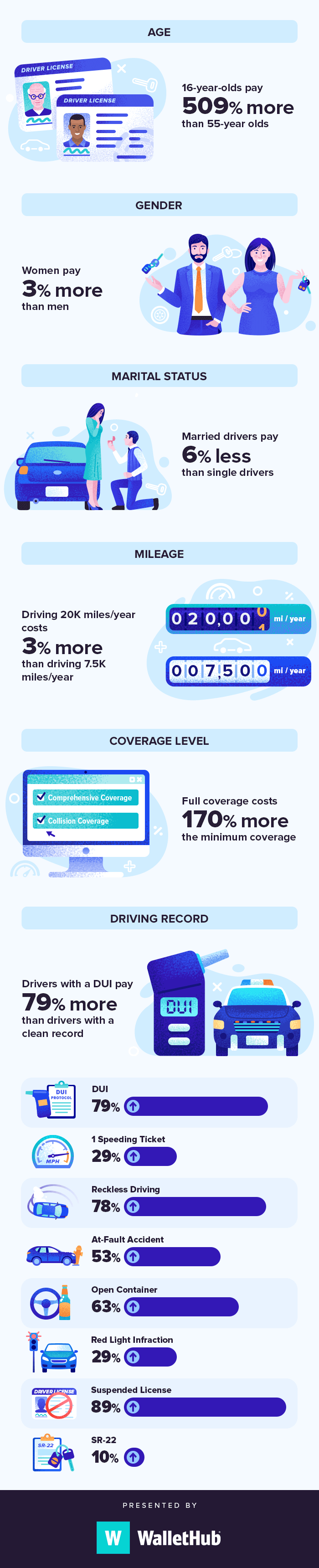

A number of factors can influence the cost of homeowner's insurance, including credit scores, home value, and roof quality. You may also see your rate calculated by your insurer based on how much deductible you choose.

Nationwide Insurance will provide you with a no-obligation homeowners insurance quote by calling us on 1-877-OnYourSide. Our experts can help determine your insurance needs and compare quotes between multiple top companies.

AM Best and other rating agencies are good places to start if you're looking for a home insurance provider in Arizona with a high financial rating. These agencies are trusted and can provide you with information about a company's customer service record, financial strength, etc.