If you're paying a high premium for your car insurance, it's time to start thinking about how you can save money on it. As well as your car payment and fuel, insurance can amount to hundreds of dollars each year. Take steps to get the coverage you need, without spending too much.

Check your policy periodically to make sure that you do not miss any discounts or specials offers. Some discounts are available for taking an approved defensive-driving class, for being a student or member of certain organizations.

You can reduce your insurance premiums by choosing a vehicle with the correct trim and safety features. This can save you a few hundred bucks a year if your car has a high MSRP.

You can lower your auto insurance costs by reducing your mileage, and avoiding parking lots. This is because your car's fuel efficiency can contribute to lower insurance costs and a less expensive repair bill in the event of an accident.

Worters suggests that raising your deductible is another way to reduce your monthly car insurance payments. Raising your deductible is a great way to lower your car insurance rates if you're prepared to save money for an accident.

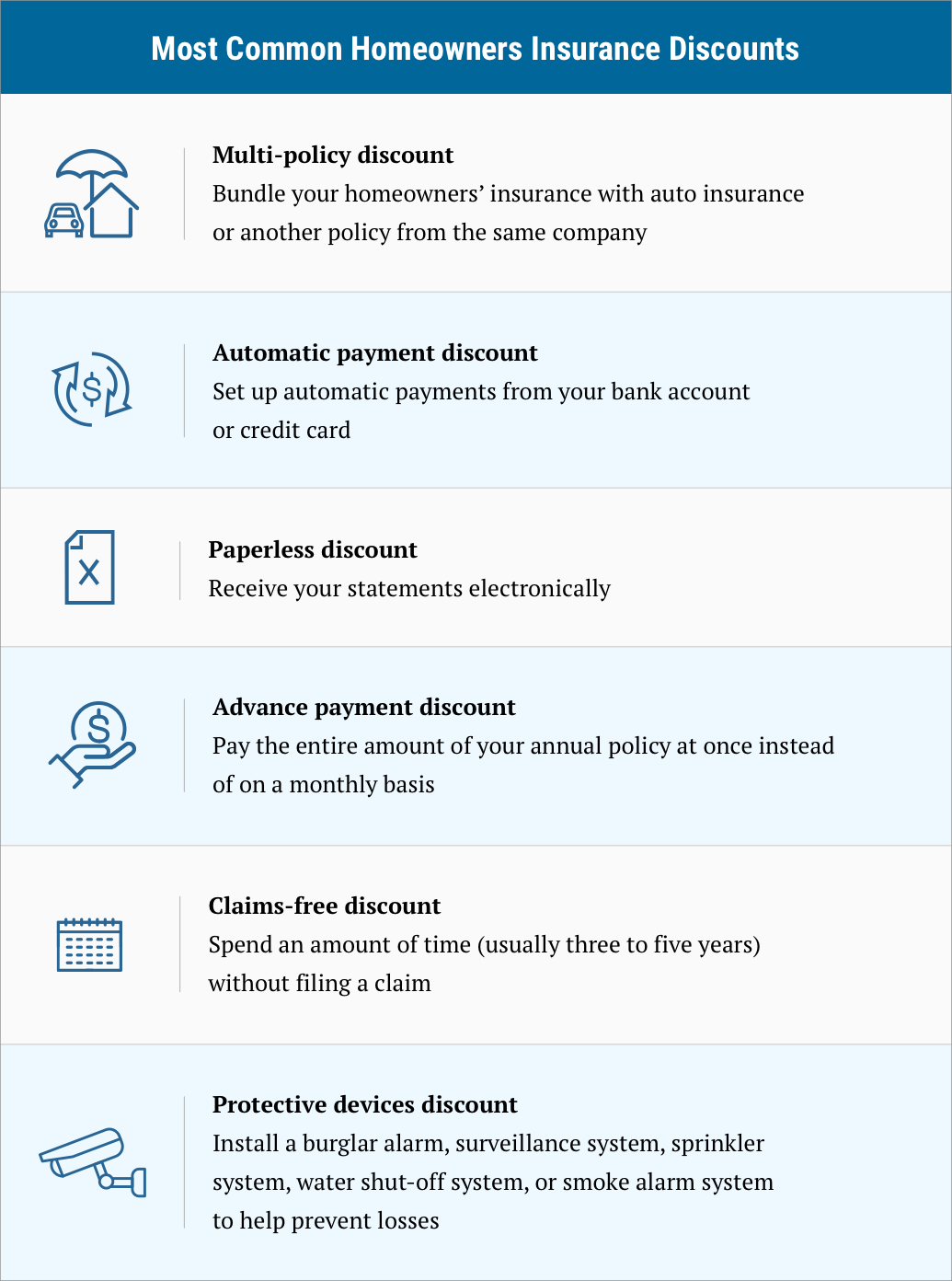

Bundle your auto insurance with a provider that offers discounts based on factors such as having multiple cars, being a homeowner, or having a good driver rating. This can help you save several hundred dollars per year, and also avoid paying for separate car payments.

Every few years, review your insurance to determine if you have made any significant changes to the policy that might lead to a reduced quote. Changes in your life could include, for instance, a new job, a change of commute or a new vehicle.

Compare quotes from at least two insurance companies prior to making a decision. This will give you the best chance of finding a great deal that's best for your needs.

Worters says that improving your credit score can help you reduce your insurance rates. A good credit score can help you save money on your insurance because it shows your ability to manage your finances and be a responsible customer.

Aside from improving your credit, you can also try to save money by paying off debts and setting up a budget to keep track of your expenses. These steps can help you to reduce your premiums and can give you an idea of how much you're spending on car insurance, which can also help you to budget better.

You can save on car insurance if you are a safe driver by enrolling in a crash prevention program or taking a defensive-driving course. This can help to prevent tickets and traffic violations that could have a significant impact on your car insurance.